Future generali assured education plan

Fill in below details to

get a call back

Thank You!

One of our associate will connect with you soon.

Why Buy Future Generali Assured Education Plan?

- This child education plan enables you to save systematically until your child turns 17 years for his/her graduation or post-graduation college fees

- Being a type of Guaranteed Income Plan, It offers you three options to receive Guaranteed payouts depending on your child's education milestones so that you receive the money when it is actually needed

- Your child's education is secured even in case of an unfortunate event in your life

- You can further strengthen your plan by opting for riders which covers you against an accidental death and/or accidental total and permanent disability

- Under this child education plan, you are eligible for Tax benefits as per prevailing tax laws

Reach us

How ASSURED EDUCATION PLAN Works?

Step 1 Choose the benefit amount i.e. Sum Assured

- Decide the amount of money you would need for your child's graduation or post-graduation college fees.

Step 2 Choose between the riders

- Opt for riders as per your need

Step 3 Receive and review the benefit illustration for your requirements

- Our advisor will help you calculate the premium amount you need to pay for this child education plan

Step 4 Pay the premium

- Be assured of enjoying protection and guaranteed payouts to fund your child's education guaranteed income plan

BENEFITS

Maturity Benefit:

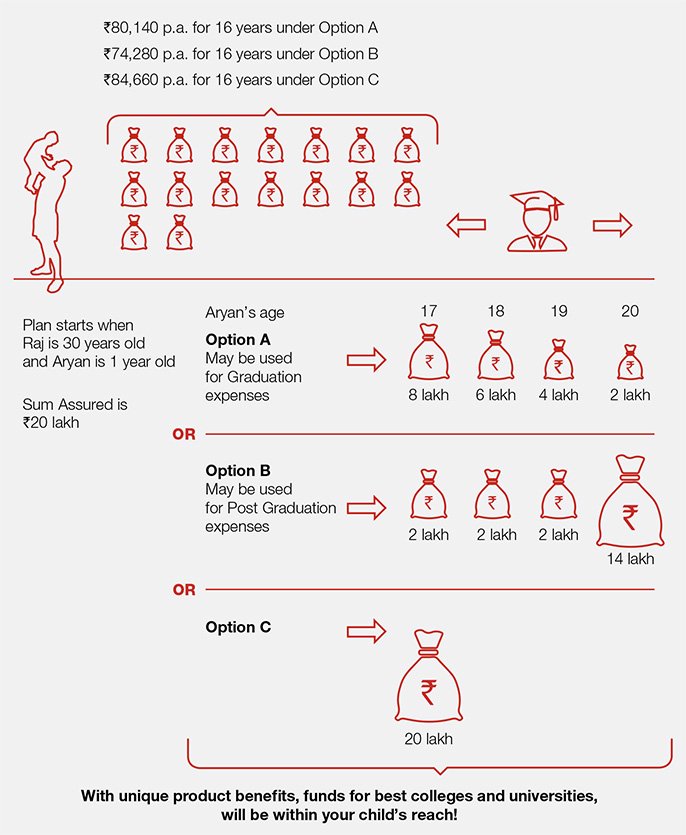

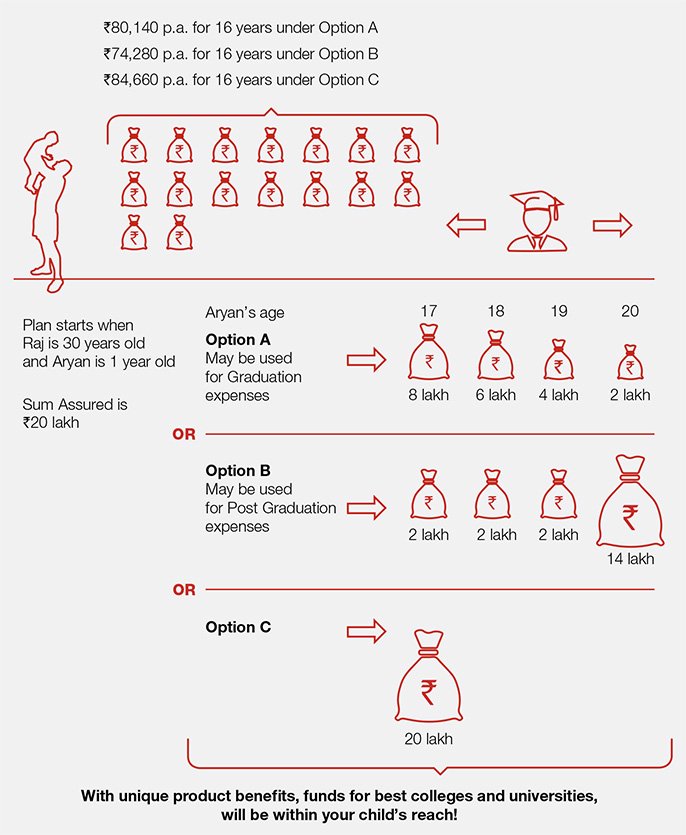

Now, you can be in complete control of your child's higher education by receiving guaranteed payouts. These payouts are designed in such a way that you are sure to use it only for payment of admission or tuition fees. Moreover, under this guaranteed income plan, you have the flexibility to choose between three options, Option A, B or C, to receive these payouts as per your child's education milestones

Let us understand your benefits with the help of an example

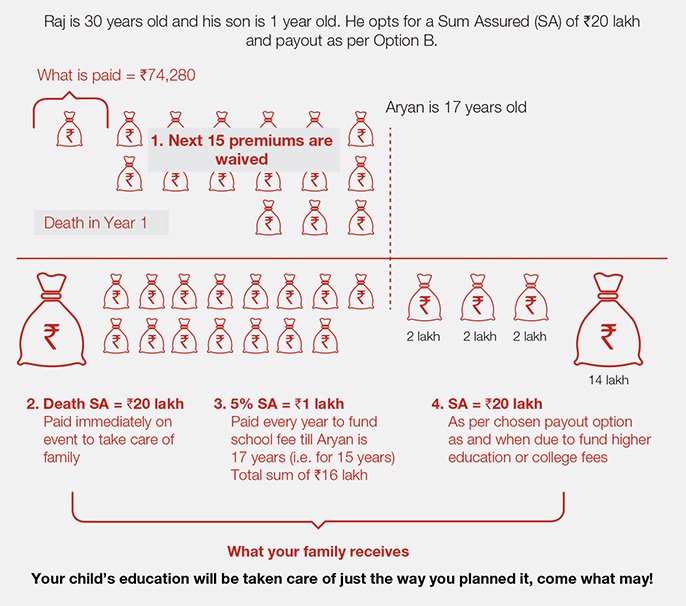

Raj is 30 years old and the father of a 1 year old, Aryan. As per his financial plan, he needs to get 20 lakhs to fund Aryan's tuition fees through yearly payouts.

- He can choose to receive the maturity benefits as yearly payouts either as per Option A, B or C.

- The Policy Term and Premium Payment Term is 16 years as Aryan is 1 year old at beginning of the child education policy

- When Aryan turns 17 years, Raj will start receiving the guaranteed payouts.

- Raj has the option to receive this as under:

| Age of your Child | Year of Payout | Option A | Option B | Option C |

| Annual premium |  80,410 p.a 80,410 p.a |  74,280 p.a 74,280 p.a |  84,660 84,660 |

| 17 years | End of 16th Year (End of Policy Term) | 40% of Sum Assured i.e.

8,00,000 8,00,000 | 10% of Sum Assured i.e.

2,00,000 2,00,000 | 100% of Sum Assured i.e.

20,00,000 20,00,000 |

| 18 years | Policy Term + 1 years | 30% of Sum Assured i.e.

6,00,000 6,00,000 | 10% of Sum Assured i.e.

2,00,000 2,00,000 | Nil |

| 19 years | Policy Term + 2 years | 20% of Sum Assured i.e.

4,00,000 4,00,000 | 10% of Sum Assured i.e.

2,00,000 2,00,000 | Nil |

| 20 years | Policy Term + 3 years | 10% of Sum Assured i.e.

2,00,000 2,00,000 | 70% of Sum Assured i.e.

14,00,000 14,00,000 | Nil |

Death Benefit

Uninterrupted protection for your child's education

Our plan ensures your child's education would not suffer in case you are not around. In such an unfortunate event, this guaranteed income plan will make sure your child gets the following guaranteed benefits to help achieve all the education milestones you have planned for:

We will:

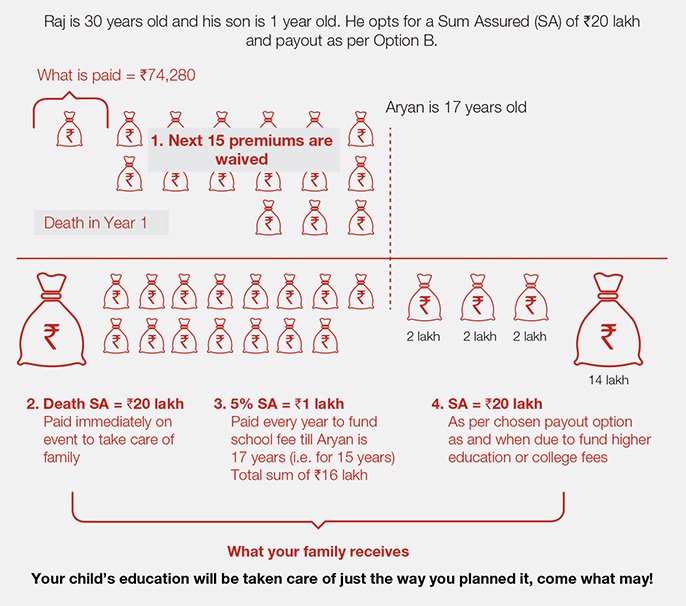

- Waive off all future premiums payable under the policy

- Immediately pay guaranteed Death Sum Assured to ensure your family's immediate needs are taken care off

- Pay 5% of the Sum Assured immediately and on every death anniversary of the life assured till your child turns 17 years. This Guaranteed amount can be used to fund your child's regular school fees.

- Pay Maturity Benefit (100% of Sum Assured) as per your chosen option while purchasing the plan

Death Sum Assured shall be highest of the following:

- 10 times Annualised Premium(excluding applicable taxes, rider premiums, underwriting extra premiums and loading for modal premiums, if any) , or

- 105% of total premiums paid (excluding applicable taxes, rider premium and extra premiums, if any) as on date of death, or

- Maturity Sum Assured, which is equal to the Sum Assured

- Absolute amount payable on death, which is equal to the Sum Assured

Let us understand the Death Benefit from the previous example:

Raj has purchased Future Generali Assured Education Plan and he opted for Option B. He meets with an accident which causes his untimely death within one year after purchasing the child education policy in India. The benefits paid out to Raj's family will be as under:

Summary of Benefits

| Your Benefits |

| Maturity Benefit | 100% of sum assured is paid in the manner as opted by you at inception |

| Death Benefit | Death Sum Assured is paid immediately to the nominee on death of the life assured. |

Target Group

For parents looking for tax saving and a good child education plan that enables to save systematically until child turns 17 years for his educational needs along with adequate life cover in case of unfortunate death.

![]()